Personal: tobacco, alcohol, books, music, clothing and shoes, donations, subscriptionsĮating Out: meals, snacks, take-out, beverages (coffee, tea, juice, soft drinks)Įntertainment: recreation, sports equipment and fees, movies, concerts, hobbies, gamingĬhild: daycare, lessons and activities, allowance, school supplies and fees, babysitting, programs, tutorsĭebt Payments: credit cards, loans, leases, support payments, government debts, personal debt Health Care: medical premiums, life insurance, medication, eye care, dental, supplements, wellness costs Transportation: fuel, auto insurance, transit, parking, taxi, rentals, car sharing, tolls

Living: personal care, bank fees, salon and spa services, dry cleaning, pet costs, memberships (fitness, clubs, associations) Groceries: food, baby needs, household supplies, toiletries Household: furnace, water tank, roof and gutters, decor, upgrades, storage locker, gardening, cleaning services, outdoor equipment and maintenance iSaveMoney is a good budget app to track.

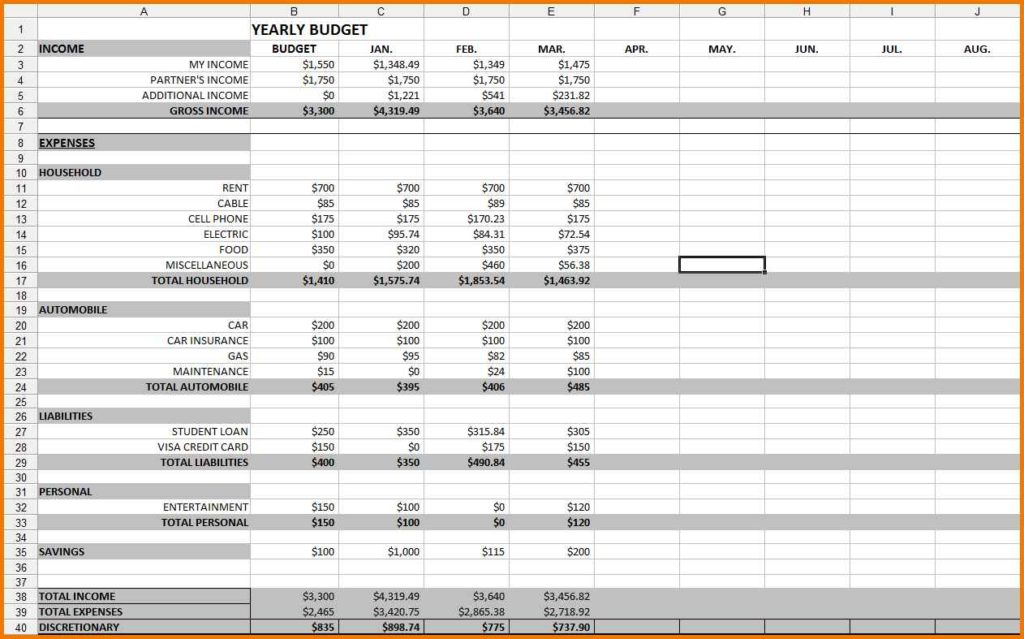

#Monthly expense sheets for excel for free#

Utilities: phone/cell, cable/internet, gas, hydro, security Download iSaveMoney for free and start taking control of your personal finance and monthly budget planning. Housing: mortgage, rent, strata fees, house insurance, property taxes View a sample of a completed tracker (from the previous version of our Monthly Expenses Tracker).Įxpense Categories – Know Where Your Money is Going This becomes the cash balance for the next week. If there’s a surplus, you should have money in your wallet or bank account. Total all columns and subtract actual expenses from actual income.On these pages, keep track of seasonal expenses rather than recording on your weekly pages. You also need to record weekly savings amounts on pages 14 – 15 of the Expense Tracker.You may want to track coffees, dining out, or fuel separately. You can then use the blank columns to create your own categories. List the dates down the left side and record actual money spent each day.You should also list any income you may expect to receive during each week. Record cash balances on hand or in your bank account.For example, a 7 day tracking period would be March 30th to April 5th. For each week, record dates you are tracking.The expense categories listed further below and on page 1 of the Expense Tracker will help you decide which expenses to record where.Open a copy of our Monthly Expense Tracker.That is, the total amount of income must match the total amount of expenses in order for it to work.

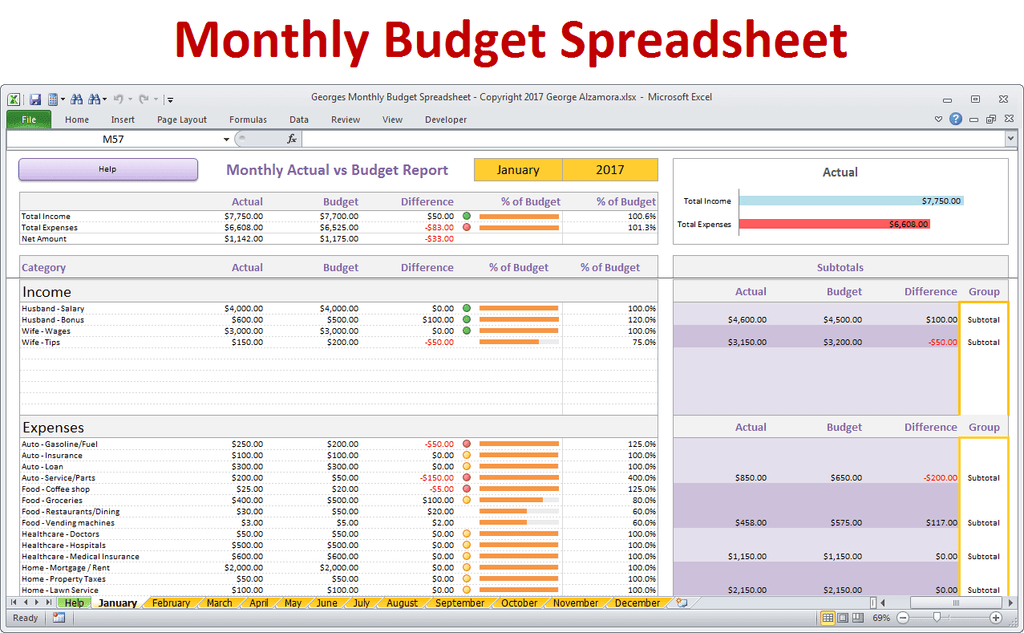

(Note that this term also has another meaning, see Wikipedia, but that's not what I'm talking about). This spreadsheet is based around the idea of a Zero-Based Budget In order to use this spreadsheet you'll have to decide what accounts you want to track with it and how you'd like to categorize your spending. transfer: money moving from one account to another.checking account, wallet / envelopes, mortgage, credit card, etc.) account: something that can contain money/debt (e.g.If you feel like helping out please improve it and submit a pull request!)īefore we dive in, I want to define some terms that I'll be using: ( Note: This documentation is incomplete. If you get stuck feel free to post a question in the "Issues" section of the Github repository. Read the instructions in the blue text boxes and try it out. Step 3: Continue tracking to help you stick to your budget. Step 2: Use that information to create a budget. This worksheet can be the first step in your journey to control your personal finances. (It does not contain any VBA scripting so might work in other spreadsheet software, but I have not tested this.) This version was created specifically for printing and completing by hand. How do I use it?ĭownload the financial-plan.xlsx file and open it using Microsoft Excel. I use it and find it helpful so I've shared it with the public for you to do with as you please. They're designed to be hard / impossible to mess up and usually include free technical support.Īlthough I've tried to make this spreadsheet pretty robust (shouldn't be able to get wrong answers without intentionally disabling the worksheet protection feature) and easy to tailor to your needs, I make no guarantees about the accuracy of its calcuations, its reliability, or any other concern. If you're not comfortable working with an Excel spreadsheet and aren't interested in learning that, I recommend using a budgeting app like EveryDollar instead. I think it is a good compromise between a full-blown accounting system (I had been using GnuCash for years)Īnd pencil and paper (if you do this by hand, props to you for your patience and organization!).ĭISCLAIMER: Although it works great for my purposes, I'm an engineer and enjoy numbers, spreadsheets, formulas, source code, etc. When my wife and I took Dave Ramsey's "Financial Peace University" course in late 2012 we created this spreadsheet to plan and track our spending. Excel-based monthly spending planner Introduction

0 kommentar(er)

0 kommentar(er)